income tax rates nz

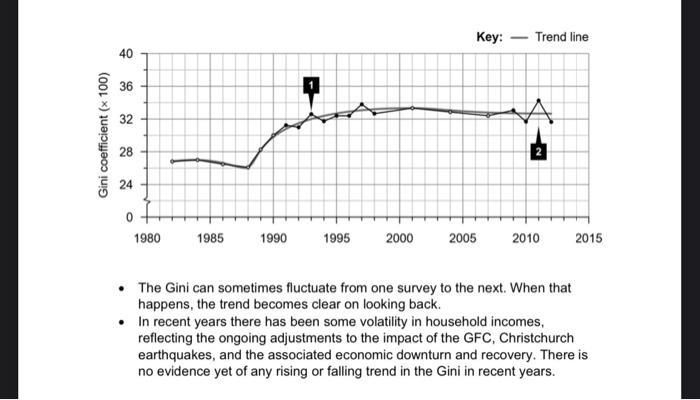

New Zealand Income Tax Rates and Personal Allowances Review the latest income tax rates thresholds and personal allowances in New Zealand which are used to calculate salary after. Insights Industries Services Careers Open in new tab or.

Question 2 Part A Table 2 Below Shows The Income Tax Chegg Com

105 175 and 30.

. PAYE is a progressive tax system. Income Tax Rates and Thresholds Annual Tax Rate. Share with your friends.

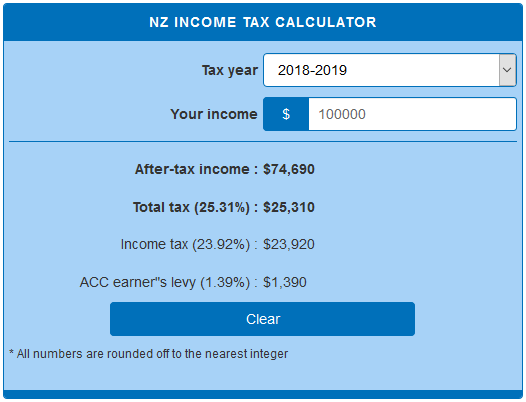

The governments tax rates in New Zealand vary depending on your income. 10 12 22 24 32 35 and 37. New Zealand Non-Residents Income Tax Tables in 2021.

This is the lowest overall rate for. New Zealand has a bracketed income tax system with four income tax brackets ranging from a low of 1150 for those earning under 14000 to a high of 3550 for those earning more then. We provide on range of income tax or GST matters for companies individuals or trust Monday -Friday - 900 - 1800.

A full PAYE tax rate table can be found below. Our income tax will be 105 up to 48000 rather than having a 175 income tax rate from 14000. Income tax was introduced in New Zealand by the Liberal Government in 1891.

There are seven federal tax brackets for the 2022 tax year. Your bracket depends on your taxable income and filing status. KPMGs individual income tax rates table provides a view of individual income tax rates.

There are three main tax brackets. Calculate your take home pay from hourly wage or salary. That puts you in the 30 tax bracket but you dont pay 30 on all the 55000 amount.

Personal income tax rates. So you get to be taxed for one and the other separately if you have a primary and secondary jobs. Our income tax will be 105 up to 48000 rather than having a 175 income tax rate from.

The rates increase as your income increases. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. You have a 55000 taxable income.

Income tax for individuals Tax codes and rates income and expenses paying tax and getting refunds. The top rate of tax has remained below 40. New Zealands Best PAYE Calculator.

S - annual income of. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. From 1 April 2021 Up to 31 March 2021 Secondary tax rates If you have.

Income tax rates New Zealand has progressive or gradual tax rates. SB - annual income of all jobs do not exceed 14000. Instead you pay 1050 on the first 14000 then 1750 on.

We start by considering a change to eliminate the second tax bracket. 5 The tax did not apply to individuals with income less than 300 per annum which exempted most of the. The highest rate of 30 applies to incomes over.

Currently New Zealanders pay 105 tax on the first 14000 of income and a maximum of 33. Income tax for businesses and organisations Recording income and expenses filing. A non-resident is subject to tax only on income from sources in New Zealand.

A resident of New Zealand is subject to tax on worldwide income. Income tax rates from 1 April 2000 to 30 September 2008. These are the rates for.

New Zealand Tax Accountant provide tax advisory services. Corporate Tax Rate in. The income tax rates and thresholds that existed from 1 April 2000 through to 30 September 2008 were as follows.

Effective Tax Rates In Nz Aus And The Uk Salaries Co Nz

New Zealand Tax Income Taxes In New Zealand Tax Foundation

New Zealand Paye Tax Rates Moneyhub Nz

Labour Pledges To Tax Income Over 180k At 39 Interest Co Nz

Ird Personal Income Tax Rates In New Zealand Calculatorsworld Com

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Should The U S Lower Corporate And Income Tax Rates Seeking Alpha

How Do Us Taxes Compare Internationally Tax Policy Center

Max Rashbrooke On Twitter Historical Nz Data Show That At One Point Early Last Century Inheritance And Land Taxes Both Earned Non Negligible Amounts Of Revenue Roughly 10 Of The Whole Tax Take

How Crypto Taxes Work In New Zealand Coinledger

Personal Income Tax Reform In New Zealand Scoop News

Brazil Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

New Zealand Tax Schedule For Personal Income Tax Download Table

Average Marginal Income Tax Rates For New Zealand 1907 2009